How should I deal with the budget if I have additional money at the end of the month? If you have additional money, the most important thing you can do is organize!

Start by organizing your spending in categories – coffee NeedsAnd set aside SavingsAnd it is intended With your Want. Follow the place where your money is going and reviewing it regularly to ensure that it is really compatible with what you can. Use budget strategies such as 50/30/20 Al Qaeda Or even the non -zero -based budget to give each dollar a purpose and avoid leaving additional money escaping.

Written by Tiffany Woodfield, Mali Coach, TEP®, CRPC®, CIM®

Rule No. 1: Do not hold money

Getting additional money such as having a lot of money in your pocket, and if you do not plan properly before you know that, you have spent everything.

Personally, this was the case for me: that the “additional” money just went to a little coffee here, and had lunch with a friend there, then went. To prevent this, I do not hold money.

Find out if this suits you – or if you tend to increase your spending credit cardTry a digital version of the same rule. For example, use one card for fixed expenses only, Set up spending alertsOr stop your card between large purchases to survive in a volatile way.

Rule No. 2: Find a way to track the expenses that suit you

My husband loves data schedules! It makes him feel organized and controlled.

If he can add a little color to the tab, even better! Although I am in funding and know how to use data schedules, I start to get out when it exceeds all the details of its data schedules. I have found ways to track my unusual expenses Data tablet tables in color.

I just keep it simple.

I can use one Google paper where I include my spending categories. I use the same visa card for everything that makes it easy to follow.

Al Qaeda No. 3: Regulation of spending in buckets

Organizing your spending in buckets can be really useful. I organize my agreement in three buckets:

- Fixed costs

- Fixed savings

- Variable costs

Fixed costs: I have set aside how much I need to cover fixed costs such as basic food and housing and anything else is a necessity.

Fixed savings: I have a specific amount of money that I set monthly for savings and/or debt payment.

Changing costs: Then look at the changing costs because I control this control of this, which is where I can get excess spending. For example, the elements in this bucket include entertainment, monthly subscriptions, gifts for birthdays, holidays, summer camps or programs for children.

Rule No. 4: Review

I would like to say that I am verifying my agreement every month – but the truth is that I review my buckets every three months, or whenever I notice additional costs or additional funds and start asking about the reason.

The key is to divide your changing expenses into categories and evaluate whether each one really appreciates.

My regime is not fancy – it’s a simple Google sheet where I included my categories.

I use the same visa card for all purchases, then I return through my guts and sort everything in its right bucket.

Every three months, I review my guts and sort every purchase in its class.

Then look at the amount of what I spent in every region and ask myself – was it worth it?

This time is usually sufficient to notice patterns without being out of the path.

Because my fixed costs and savings have already been allocated, it’s factor Spending Review to find out where I can adjust.

Sometimes I find myself regret the purchases that did not bring real value.

When this happens, I use the backup strategy: note what I spent, and move forward, this type of spending is re -directed to a separate savings account instead.

After a few months, I built enough to put something more feasible – or to provide a future adventure.

You can feel additional money such as “found” money, but the goal is to spend it in ways to bring joy in the long run, not just a quick solution.

Budget when you have additional money

It may be a good strategy to have a more organized approach, especially when the first budget is.

Why? Well, because you need to understand where your money is going and setting goals, so you are moving towards something that raises you!

This is especially important when you have additional money because it corresponds to your spending with long -term goals and prevents you from spending without great thinking.

A couple of my favorite end in the budget is:

- 50/30/20 Al Qaeda

- Budget based on zero

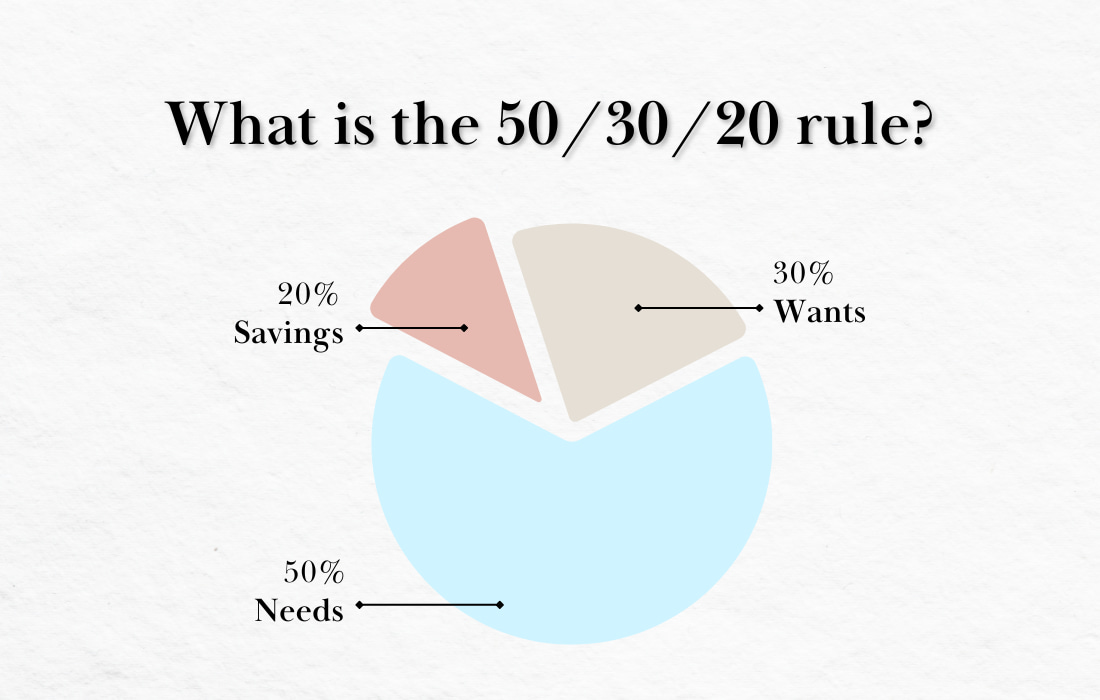

Using the base of 50/30/20

the 50/30/20 Al Qaeda It is a simple business framework to help you manage After the tax Effectively:

1) 50 % on needs

Customize half of your income for basic expenses –Housing, facilities, grocery, transportation, insuranceAnd the other basics required to live and work.

2) 30 % on desires

Use up to 30 % for the foundation that improves the quality of your life, such as Eat food, entertainment, hobbies and leave.

3) 20 % on savings and debt payment

Put the remaining 20 % towards The financial future. This includes Building an emergency fund, contributing to retirement accountsOr investment or Pay the debts high interest.

Budget based on zero

The zero -based budget is exactly what it looks: an approach that must be justified by all expenses, starting with the “zero base”.

This means that each dollar of income is allocated to specific expenses, savings or debt payment, which ensures that income minus expenses is equal to zero at the end of the budget period.

The zero -based budget is a practical approach that helps you become more intended with your money.

The idea is simple: at the beginning of each month (or payment period), you can set Each one dollar From your income a specific function – whether it covers an invoice, savings, investment, or debt payment. The goal is “zero” your budget, meaning Your income minus expenses is equal to zero– But not because the money has been done. That is because you told every dollar where you go.

For example, if you earn $ 10,000 a month, you can allocate:

- $ 4000 for fixed costs (such as housing and insurance),

- 2000 dollars for savings and investments,

- $ 1,000 to pay off the debt,

- $ 2000 to spend lifestyle,

- And $ 1,000 for future goals (such as travel or education).

This approach is especially useful if you have a high income but still wondering, “Where do all my money go?”

By setting every structure dollar, you gain clarity, control and confidence in your financial decisions – without feeling restrictions.

| Budget | How to work | Best for | Why help |

|---|---|---|---|

| 50/30/20 Al Qaeda | Income division: 50 % needs, 30 % want, 20 % savings/debt. | Beginners who want a basic building. | easy To follow, it enhances balance. |

| Budget based on zero | Each dollar is set; Income minus expenses = 0 dollars. | The owners of the meter, Details directed the people. | He increases Control And accountability. |

| Budget bucket | Classification of fixed costs, savings, and changing costs. | visual Thinkers, those who want flexibility. | It makes spending habits Make up. |

| The budget element line | Follow individual expenses in detail. | People with factor income Or expenses. | Great to increase improvement. |

| 1/3 Al Qaeda | Allocating 1/3 for needs, 1/3 to desires, 1/3 to savings/debt. | Independent Or entrepreneurs. | Simplify Decisions, avoiding guilt. |

10 tips to manage your budget wisely

Getting additional money is a great opportunity to reach your financial goals.

If you earn well and live under your capabilities, follow these tips:

- Follow your coming money and leave every month.

- Create short -term goals to feel inspiring today.

- Develop long -term goals so that you can plan for the future.

- Detail of high interest debts.

- Increase your monthly savings.

- Invest your savings to generate negative income.

- Track and evaluate your progress so that you can reward yourself along the way.

- Consider savings buckets – for example, savings for this year’s journey in exchange for retirement.

- Savings automation.

- Use tools that work for you, such as data schedules or applications.

Quick Video: 3 tips to start the budget

You can use this Three simple steps tips to start the budget So you can achieve financial freedom more quickly and easily! Make sure to click the subscription button if you are a YouTube user until you get more videos in your salvation.

Do you invest your additional money?

When you have additional money, it is important to start investing so that you can earn a negative income and take advantage of the double benefits.

Whether you want to do it yourself or work with a consultant is an individual decision.

A word of advice: Invest in the long run and avoid trying to “market market”. In addition, make sure that your investments are in line with your goals; For example, if you need money in the short term, invest in more liquid assets.

On the contrary, you can get a long -term bucket where you can ride market fluctuations.

Question and answer about the budget when you live comfortably

What is the best way to use additional money?

The best way to use additional money is DebtStarting from high -interest debts; Create a safety network in the event of a position in which you do not earn money for a while; Invest your money.

Do I have to provide or invest my additional money?

When determining whether you will provide or invest your additional money, it is useful to ask how you should Classification of your extra money And what you need. Understanding a time schedule for a time that needs your money is very important. When saving, make sure that your savings are liquid so that you can easily reach it if necessary. Once you allocate this money, you can consider more long -term investments.

How much is my additional money that should go towards debt?

A common recommendation is Allocate at least 20 % of any additional money Towards debt payment, especially high -benefit debts. However, the specified amount will vary based on your financial position, goals and interest rates on your debts. It is necessary to balance the payment of debts with savings and investment.

Is it acceptable to spend additional money on enjoyable things?

Yes, just make sure it is something you are Real value as fun. Remember that we are not proud of the same things. For example, I love beautiful clothes and travel, but I don’t see a great value in eating in the last restaurant. So, before you spend your “additional money”, ask yourself if something really loves you instead of what you think you should love. Enjoy it without guilt.

What are the smart ways to develop additional money?

Smart methods for Additional money grows It includes winning negative income through investments in the stock market, contributing to retirement accounts, and opening a high -interest savings account.

Get the free guide and audio meditation to show your dreams

Broadcast

You will also get e -mail messages or two per month with the latest blog posts about abundance, building wealth, showing and creating a satisfactory life.

Read more:

💎 What is the budget for the line?

💎 Budget base 1/3 and how to use it in the right way

💎 Budget 101: How to create and follow a simple budget

About the author

Tiffany Woodfield He is a financial coach, an expert across the border and co -founder of Swan Wealth, based in Kelowna, BC. As director of TEP and wallet manager, Tiffany has extensive work experience with successful professionals who want to leave a legacy and enjoy an adventure lifestyle and work manufacturing. Tiffany combined the wide knowledge of its background as a financial professional with training and her passion for personal development to help its customers create a unique road that allows them to live in their maximum capabilities. Tiffany was a regular contributor to Bloomberg TV and was interviewed with national and international publications, including Globe and Mail and Barron.