Although many drivers view cars insurance as a fixed monthly cost, the reality is that your daily habits behind the wheel directly affect the prices you pay. Every time you fail to drive, the decisions you make – whether it is the length of your move or your level of caution on the road – calls a message to insurance companies about your risk profile. These habits extend beyond the effect on maintaining and destroying your car; They play an important role in determining the amount you pay for Personal car insurance. Understanding the impact of common driving patterns on your insurance premiums is vital for any driver who wants to manage costs and avoid high unwanted interest rates, especially since insurance companies improve their pricing models using advanced analyzes.

Insurance companies are increasingly looking beyond just making your car, your model, and where you live. The most accurate data groups are now working on the number of miles that they lead, the times of the day they are going on the road, and any roads that you travel routinely. These complex accounts aim to predict more accurately the risks of accidents and sewing rates accordingly. What this means for drivers is a greater transparency about how personal behavior affects installments – and most importantly, more opportunities to control what you pay. The following sections are divided exactly how daily driving procedures constitute insurance rates on your car, and provide guidelines about pre -emptive steps to achieve the best possible results.

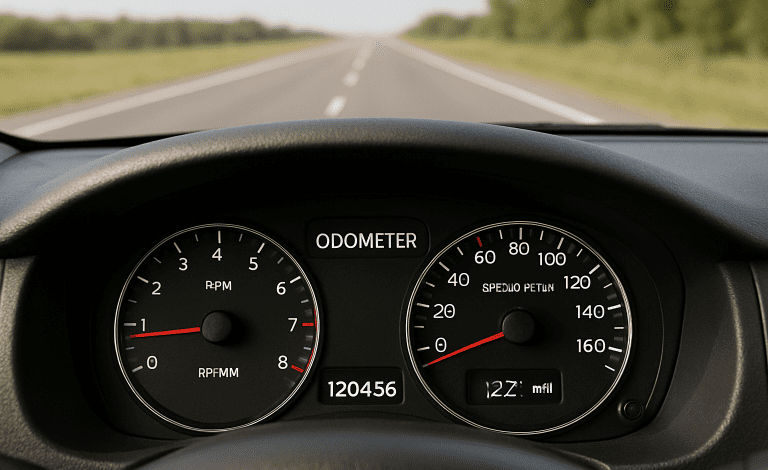

Understanding miles and its effect

One of the most important, but often reduce it, insurance prices are the annual miles. Insurance companies have established, by collecting extensive data and actuarial studies, that there is a direct relationship between the number of miles covered by the driver every year and the possibility of participating in an accident. The logic is clear and direct: the more time you spend on the road, the greater your exposure to risks such as the drivers, the dangerous weather, or the wildlife. It is worth noting that the jump in the annual miles from 5000 to 20,000 miles can increase the national average premiums by about 9 %, but this number fluctuates significantly according to the state.

Insurance companies analyze the annual miles because each additional mile raises the statistical opportunity will be in a collision or needs a claim. This does not affect impartially on drivers with long transportation, rideshare drivers, or people who use their cars routinely for tasks and jobs related to work. Even the simple increases in the number of kilometers-for example, can take you part-time delivery-from a low-risk category to a higher category in the eyes of your insurance company. Consequently, keeping your insurance company updated about the changes in your driving patterns is very important, as you may qualify for low -miles discounts or avoid paying higher prices if your use decreases, such as switching to remote work. Always see your policy details and speak directly with your insurance company about the number of typical kilometers if you think the risk profile has changed.

Driving behavior and insurance premiums

Behind the raw miles, your driving behaviors and history behind the steering wheel play a major role in determining what you pay for coverage. Insurance companies follow violations and accidents accurately because they are tangible indicators of risks. Your driving record provides a detailed date on how to deal with parking on the road – starting from the limits of obedience to the appropriate response in emergency situations – and directly affects the amount that will be collected for insurance.

Violations of speed and traffic

Quick tickets and other moving violations act as red signs for insurance companies. In a short period of time, multiple tickets can lead to your position in a higher risk slice, which directly leads to increased installments, as insurance companies believe that you are more likely to cause an accident. Some companies may refuse to cover or refuse to renew your policy if the violations persist. Maintaining a clean record by adhering to the published speed limits and traffic lights is not only related to safety – it is a proven way to manage insurance costs.

History accidents and demands

Every time you submit a claim to a fear accident or report frequent losses, your risk profile rises. Insurance companies are your previous claims predicting future accidents, and therefore it can add a history of simple barriers, which increases your installments year after year. On the other hand, drivers with bright history or minimal claims are qualified to obtain accident free and lower rate discounts.

Driving under the effect (the only identity document)

The condemnation of the only identity document carries especially harsh consequences for drivers. Insurance companies may double or multiply your installments three times – or in some cases, completely cancel your policy after condemning the only identity document. Even after the completion of legal penalties and any required programs, the only identity document can chase your prices for years. Some states even require drivers who have Duis to buy special and more expensive insurance forms, known as SR-22 coverage, putting more pressure on your budget.

The role of Telematics in modern insurance

Technological innovation changes the face of car insurance. Increasingly, companies depend on remote Or use insurance models, which use devices inside the car or mobile applications to track the actual time visions. These programs record information such as your speed, the difficulty of the brakes, the speed of your acceleration, and the times of the day you lead. For example, repeated trips can be lifted late at night-associated with high accident rates-your risk level, while avoiding high-risk time frames may reduce this.

Participation in TELEMATICS programs can be especially useful for safe and careful drivers. Several insurance companies offer great discounts on document holders who constantly show good habits, such as smooth braking, safe speeds and expected driving routine. On the contrary, risky maneuvers – such as rapid acceleration or harsh stop – can lead to high fees. These programs provide flexibility and give drivers greater impact on their insurance results, allowing a good performance reward immediately, rather than waiting for years of clear records.

Tips to reduce your insurance installments

Keep a clean driving record

Adoption of safe and conscience driving habits is the most effective way to maintain affordable prices. Avoiding accidents, guidance, and avoiding traffic censorships, and taking defensive driving courses, all helps reduce your risk file and qualify for safe value discounts. Remember that any violation or claim can increase your installments for years, which makes defending driving with long -term benefits.

Reducing your miles

Reducing the miles you put on your car every year not only reduces the possibility of an accident but can have a direct impact on your insurance costs. Simple changes – such as a remote record when possible, participate in car escorts, or replace long flights with public transport – can significantly reduce the total annual. If your circumstances change, such as starting to work from home or retirement, always inform your insurance company to ensure that your prices are low and your driving habits allow.

Participate in Telematics programs

If you are a safe driver, registration in the TELEMATICS program is a direct way to gain savings. By sharing the data voluntarily, you can show less risks and receive discounts designed on your performance. Some programs even provide notes in the actual time, which helps you correct risky habits and increase your position.

Shopping

The car insurance market is very competitive, so it pays to compare options regularly. You may find significant differences in equivalent coverage rates – some companies may provide unique discounts for a decrease in the number of kilometers, remote participation or assembled packages. The review of multiple insurance companies ensures and quotes them annually that you benefit from the most competitive prices available.

conclusion

Insurance premiums are not placed on your car in the stone, nor are it based only on your age, value of your car, or where you live. Today, they are formed daily through your individual driving styles and behaviors. By understanding how miles, driving habits and technological factors such as remotely on your prices, you enable yourself to make more intelligent options behind the wheel. Monitor your annual miles, show safe driving, embrace Telematics, and constantly search for the best deals are all strategies that maintain your auto insurance policy both effective and affordable. Small adjustments add to the driving routine quickly, providing meaningful savings and making roads more safe – and less expensive – for everyone.