Can money save you to become rich?

Small and consistent savings grow over time. With smart investment and complex interest, your savings can help you build wealth. The key is to think in the long run and adhere to your financial success!

Written by Tiffany Woodfield, Mali Coach, TEP®, CRPC®, CIM®

Steps to create wealth through savings

These are some simple steps that you can take to start building wealth by saving money:

- Be sure and accountable for your spending patterns

- Create a goal to work for

- Understand your current financial situation

- Eliminate debt

- Follow your spending

Can money save you really get rich?

One of my favorite stories is from Joseph Lake, who was no It is considered a rich man, but rather the miser.

He was wearing used clothes, watching television in his neighbor’s house because he wanted to provide electricity, and lived in a corridor house.

It was not until the 90 -year -old died that his daughters learned of his wealth when he donated about $ 1.8 million to direct dogs to the blind. He created this wealth by squirrel away from money and not spending it.

It is likely to be driven by fear of running out of money.

But you do not need to be on the short side to build wealth through savings.

Instead, building wealth revolves around finding a balance where you can provide a certain percentage today to achieve a future goal while continuing in your life and not being a severe penny.

Invest in the owner of intelligence and eq

It is important to invest time in increasing your understanding of money concepts so that you can make better financial decisions.

This is the intelligence of your money and includes learning about savings, investment and ways to earn more money.

Eq money is your relationship with money. All your deep feelings include roots and feelings and Beliefs about money. Without investing in understanding and working on your money IQ and eq, you are trying to make financial decisions with one hand behind your back.

I advise you to read some of my blog posts about Mental of money and Malian blockage To help you enhance your money EQ.

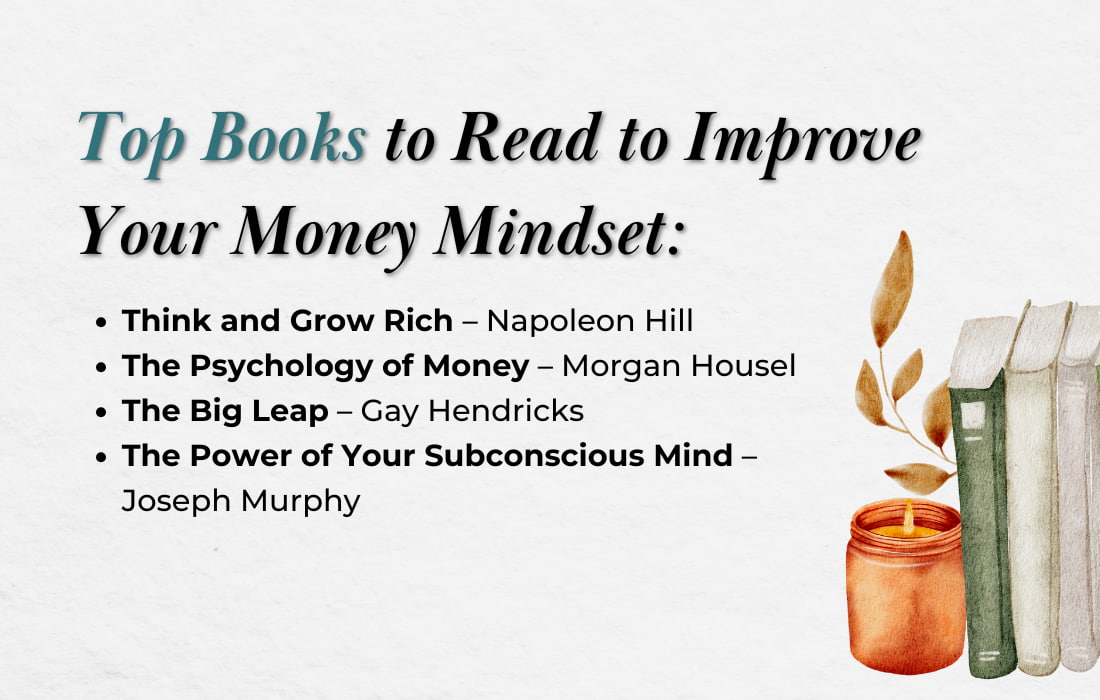

The best books that you can read if you want to increase your money mindset

If you want to improve your money mentality, reading books on this topic is a great start.

My favorite Money MindSets books are:

- Think and grow rich, Napoleon Hill

- Money Psychology, Morgan Hosel

- The power of your subconscious mind, Joseph Murphy

- Large jump, gay, Hendricx

These books discuss the power of your unconscious ideas and how these ideas affect all your decisions, including your ability to build wealth.

Question and answer

How to build wealth with savings?

One of the best ways to build wealth with savings is to invest your money to earn a negative income and take advantage of the double benefits.

This means investing your money in the long run and allowing it to grow. You want to invest in a balanced and varied way to be patient and stay in the course.

Once the level of assets exceeding one million dollars can be achieved, working with an advisor can help you invest your money and work as a guide to keep you on the right path of financial freedom.

What is the trick to save money?

The trick is to save money in understanding your current financial situation and how much money that enters and comes out every month.

Next, select if you have any surprises, areas that you have not realized that you spend a lot on them and cannot. These are the elements that are easier to cut.

Next, create a goal, realistic schedule and budget to keep you on the right track.

If possible, Automated your savings So you do not have to think about the matter or the temptation of his spending. Remember that the trick of saving money is to stay in the path and not surrender.

How much should I save to build wealth over time?

There is a good base represented in spending 50 % of your income at home on the needs, 30 % on the needs, and 20 % on savings or debt payment.

Also, using a percentage of your income, you should be able to save more when earning more.

How does the compound interest help my savings grow?

Complex benefit helps your savings to grow because earning attention increases the main balance of your account.

For example, if you have $ 100,000 and get an 8 % interest using the vehicle, your new balance will be your acquired benefit ($ 100,000* 8 % = 80,000 dollars) and your original deposit for the total $ 108,000. If you do this over many years, your wealth will grow.

What is the difference between savings and investment?

Savings is to put money aside to reach a goal, while investing puts your savings on something with expectation to earn a return over time.

When you provide, you can think that it is storing your money below your rank. While with investment, you take your savings and put it at work.

How can I avoid spending money on the things I do not need?

- Create Budget and path where every dollar goes.

- Every month, Look In your bank data and credit cards to determine if you have any continuous fees for the services you do not need.

- Use Cash only

- Understand What you can spend money on it

- Ownership The goal of savings you are working on

- exclude The temptation by canceling the subscription to store emails and reduce social media

- Stop Before each purchase.

Quick Video: 5 basic elements of the budget that everyone needs to know

These five elements of the budget are very important to consider when creating a financial plan that helps you build a lifestyle of work option and financial freedom.

Get the free guide and audio meditation to show your dreams

Broadcast

You will also get e -mail messages or two per month with the latest blog posts about abundance, building wealth, showing and creating a satisfactory life.

Related articles

💎 How to become rich in saving money

💎 How to change your mind to earn money

💎 What is the best way to save money?

About the author

Tiffany Woodfield He is a financial coach, an expert across the border and co -founder of Swan Wealth, based in Kelowna, BC. As director of TEP and wallet manager, Tiffany has extensive work experience with successful professionals who want to leave a legacy and enjoy an adventure lifestyle and work manufacturing. Tiffany combined the wide knowledge of its background as a financial professional with training and her passion for personal development to help its customers create a unique road that allows them to live in their maximum capabilities. Tiffany was a regular contributor to Bloomberg TV and was interviewed with national and international publications, including Globe and Mail and Barron.