Trusts and estate planning in the United States and Canada

Wondering when to use a trust for estate planning?

You are not alone. Estate planning It is a complex topic. The answer depends on where you live and your goals.

Written by Tiffany Woodfield, Financial Coach, TEP®, CRPC®, CIM®

In the United States and Canada, the most common reasons people use an estate planning trust are:

- To avoid probate, which can be long and expensive.

- Control how their assets are distributed.

- To further protect assets from creditors or lawsuits.

- To reduce property taxes, e.g Irrevocable trust Which removes assets from a taxable estate in the United States. to be sure Types of trusts in Canadasuch as family trusts and alter ego trusts, help with tax planning.

- To assist with disability planning so that their finances continue to be managed accordingly.

- Maintaining privacy is important because wills become public records, and trusts generally remain private.

Overall, trusts are versatile tools for individuals who want to manage their estate planning efficiently and in accordance with their specific wishes.

What exactly is trust?

A trust is a legal arrangement where one person (the trustee) holds and manages assets or property for the benefit of another person or group (the beneficiaries).

It allows the person who created the trust to control and protect the assets during his lifetime and after his death.

How do trusts work in estate planning?

In estate planning, a trust is often used to avoid a long and expensive probate process, allowing beneficiaries to receive their inheritance sooner.

A trust provides a greater level of privacy than a will. It can also provide tax benefits, assist with planning for minors or beneficiaries with special needs, and allow… donor To maintain control over asset allocation.

The grantor is the person or entity who creates the trust and transfers the assets to it. Also called donors Settlers or trust.

You may have noticed that estate planning is full of jargon, but don’t let that hold you back from deciding which step is right for you. I recommend that you read some articles about estate planning and then seek advice from an estate planning advisor or financial advisor who can help you with estate planning.

When should I consider using a revocable trust versus an irrevocable trust?

Most people consider A Revocable trust When they want flexibility and control over their assets during their lifetime.

This type of trust allows the grantor to modify or revoke the trust at any time, making it suitable for anyone anticipating changes in their financial situation or estate planning needs.

In the United States, many people use revocable trusts To place their homes, investable assets, bank accounts, business interests and personal property.

Revocable trusts are less common in Canada Due to lack of legal recognition, limited tax savings, and cost of setup and maintenance.

that Gears are irreversibleThis is suitable for anyone seeking to protect their assets from creditors, Reduce property taxesOr provide for beneficiaries after death. The difference is that the donor I cannot Amend or change a trust once it is created.

How can a trust help reduce estate taxes?

A trust can help reduce estate taxes because the assets are held in Irreversible Trust They do not form part of the deceased’s estate, resulting in reduced estate taxes.

Additionally, the trust will not have to go through the expensive and time-consuming probate process. Furthermore, trusts help facilitate gifting strategies before death, reducing your estate and the amount the government can tax.

Taxes at death can eat up a significant portion of a person’s estate, reducing a loved one’s inheritance while lining the government’s pockets. For this reason, tax planning is an important part of estate planning.

What are the benefits of using a trust to protect assets from creditors?

When the grantor places assets in an irrevocable trust, he no longer owns or controls them.

These assets are now in the trust’s name, limiting creditors’ access to them. However, if a trust is created to defraud creditors, the court may deem it invalid.

Does a trust simplify the transfer of wealth to beneficiaries?

It is not a clear yes or no answer, as each individual’s circumstances are different and must be carefully considered.

However, I can confidently say that Effective estate planning simplifies the transfer of wealth to beneficiaries. By proactively seeking advice and creating a thoughtful estate plan, you can identify strategies to protect your loved ones and your legacy.

Can a trust help plan for a family member’s special needs?

Yes Disability trust in the United States And a Qualified Disability Fund of Canada Allowing families to set aside money in a trust to support people with disabilities without affecting their eligibility for government benefits.

The beneficiary can still receive income from the fund to cover daily living expenses, medical expenses and other needs. These boxes provide great comfort and peace of mind that their loved ones will be taken care of now and in the future.

What is the process of establishing trust?

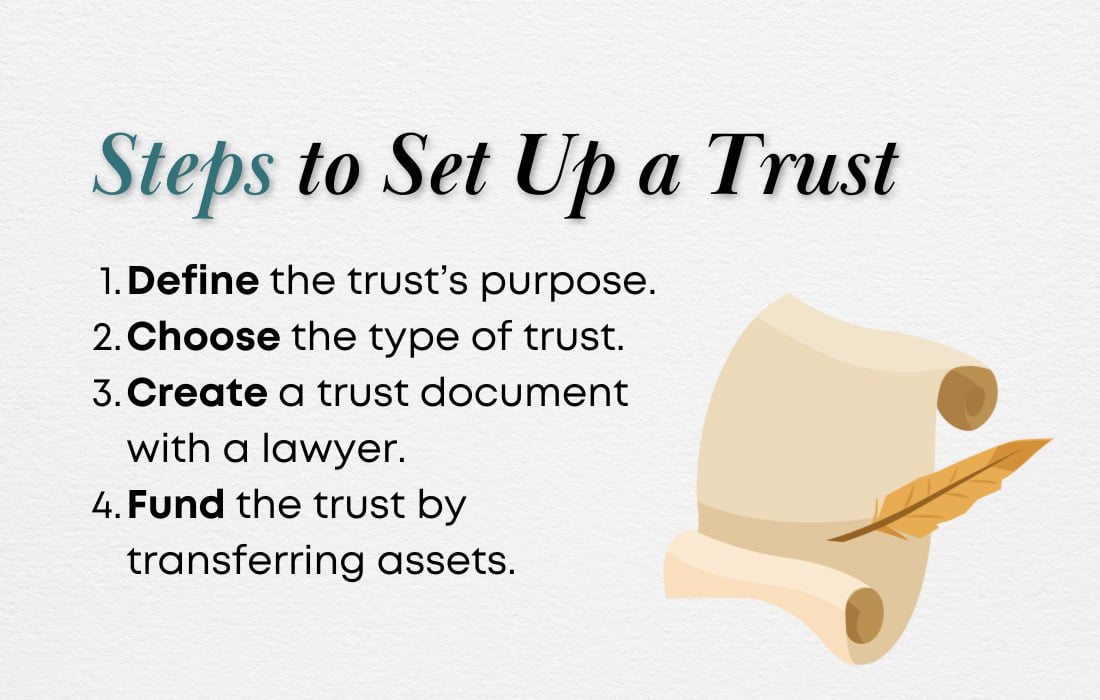

- First, define trust very. Is it for estate planning, asset protection, special needs, or some other purpose?

- to set Trust typesuch as a revocable or irrevocable trust, a living or testamentary trust, a charitable or asset protection trust, a special needs trust or a family trust.

- Create inRust document with an estate planning attorney. Determine who the trustee(s) and beneficiaries will be and what your wishes are for the management and distribution of the assets.

- Fund the trust. This is where you transfer the assets to the trust, and they will now be the property of the trust and managed by the trustee in accordance with your wishes.

Do I need a lawyer to set up a trust?

It is not legally necessary to hire an attorney to set up a trust.

However, I highly recommend using one because the cost and risk of your mistakes are much greater than the cost of advice. Trusts are complex legal documents that must be structured appropriately to comply with relevant laws and effectively carry out your intentions.

Final thoughts

Using an estate planning trust in Canada or the United States can be a game-changer when it comes to protecting your legacy and simplifying the wealth transfer process.

However, trusts are not a one-size-fits-all solution, and their effectiveness depends on your unique circumstances and goals. That’s why working with a financial advisor and estate planning attorney is so important. These experts can guide you through the complexities of tax laws, asset protection, and family dynamics to craft a strategy that reflects your values and priorities.

By taking the time to plan thoughtfully and seek professional advice, you can protect your loved ones, preserve your wealth, and ensure that your wishes are carried out smoothly. Estate planning is not only about transferring wealth, it is also about peace of mind for you and your family.

Finally, remember that everyone needs to do estate planning. It’s not just billionaires. If you plan to leave an inheritance to your loved ones, it is important to ensure that it will not be excessively taxed and that your wishes will be followed.

Summary of key points

- Avoid the will: Trusts simplify inheritance by bypassing the lengthy and expensive probate process.

- Asset Allocation Control: Make sure assets are distributed according to your wishes, including provisions for minors or beneficiaries with special needs.

- Tax efficiency: Reduce estate taxes through strategies such as irrevocable trusts in the United States and family trusts in Canada.

- Asset protection: Protect wealth from creditors and lawsuits by structuring the appropriate trust.

- Disability plan: Trusts ensure that finances are managed if you become unable to handle them personally.

- Seek professional advice: The cost of working with a professional is worth it in the long run. You don’t want to make costly mistakes that create chaos for your loved ones.

Get the free guide and audio meditation to make your dreams come true

Enter your email address in the form below to receive our easy checklist, manifestation guide, and guided audio meditation to help you get started.

You’ll also receive one or two emails a month with the latest blog posts on abundance, building wealth, manifesting, and creating a fulfilling life.

Related articles

💎 What to bring to an estate planning appointment

💎 What is estate planning in Canada?

💎 Why is generational wealth important?

About the author

Tiffany Woodfield He is a financial coach, cross-border expert, and co-founder of SWAN Wealth based in Kelowna, BC. As a TEP Director and Associate Portfolio Manager, Tiffany has extensive experience working with successful professionals who want to leave a legacy and enjoy an adventurous, career-optional lifestyle. Tiffany combines extensive knowledge from her background as a financial professional with coaching and her passion for personal development to help her clients create a unique path that allows them to live their fullest potential. Tiffany has been a regular contributor to Bloomberg Television and has conducted interviews with national and international publications, including the Globe and Mail and Barron’s.