Should I use a trust for my estate planning?

Trusts are a valuable tool for effective estate planning in Canada and the United States because they allow you more control over the distribution of your assets. But not everyone needs trust. Learn who needs a trust and why use a trust for estate planning.

Written by Tiffany Woodfield, Financial Coach, TEP®, CRPC®, CIM®

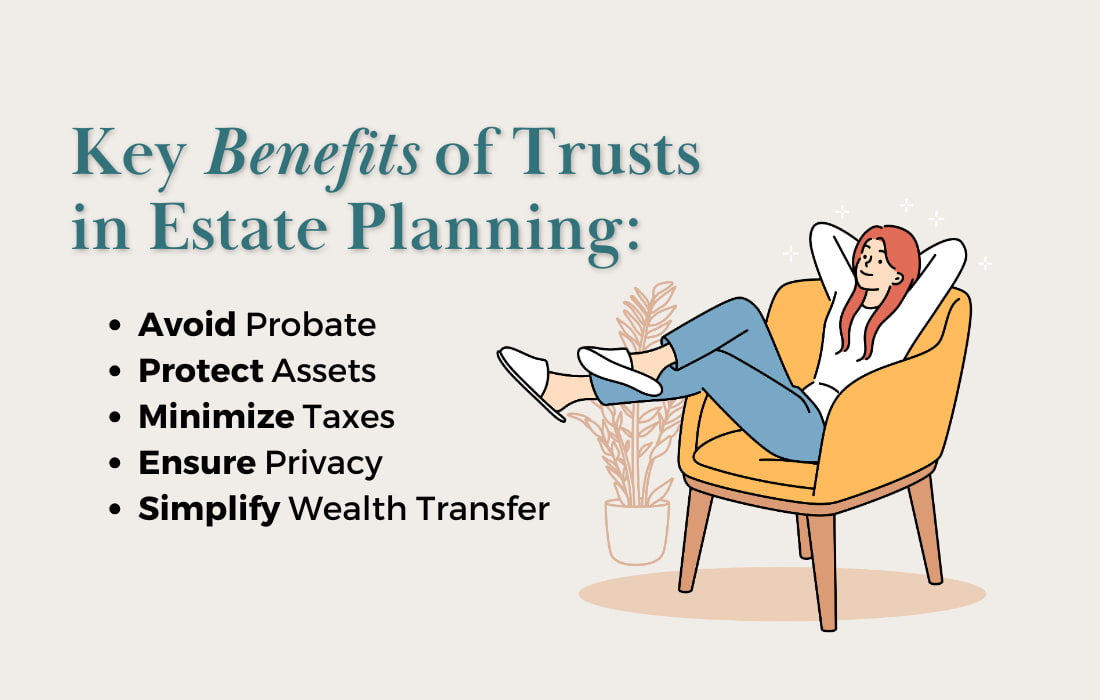

Trusts can help ensure that your beneficiaries (also known as people you love) receive their inheritance as intended.

They can also help make the transfer of wealth smoother by avoiding a lengthy probate process, providing privacy and asset protection, and reducing estate taxes.

But before we get started, here’s a word of warning. Not all trusts work the same way, and to make sure they work the way you want them to, you should seek legal advice when setting up a trust. For more about When to Use a Trust for Estate Planning, read this post.

What is trust?

A trust is a legal arrangement in which an individual, The trustworthytransfers ownership of their assets to A Guardianwhich manages those assets according to the terms set out in the trust deed. This contract ensures that the assets are managed and distributed according to the trustee’s wishes during their lifetime and beyond.

How do trusts work in estate planning?

Many people use trusts to avoid probate when they die.

Assets held in the trust are not part of your estate and, therefore, are not subject to probate upon your death. Assets held in a trust can be distributed more quickly than if they were to go through the probate process.

How can a trust help protect my assets?

Trust assets can be protected from lawsuits, creditors, and divorce claims if properly structured.

Additionally, when you set up a trust, you can clearly define your intentions regarding the assets and the rules for when and how they may be distributed. For example, children can be beneficiaries without actual control of the assets.

What are the tax benefits of using a trust for estate planning?

Canada

In Canada, typically, death is considered a major taxable event because when an individual dies, there is a significant disposition.

It’s as if you sold all of your assets right before you died, and taxes become due on any capital gains.

However, when the family trust owns the assets, the death of an individual does not create a tax liability on the assets held in the family trust because the individual has no ownership.

Therefore, the estate’s ultimate tax liability may be significantly reduced.

A trust can also allow multiple beneficiaries to take advantage of the lifetime capital gains exemption (LCGE).

USA

The use of trusts for estate planning in the United States can provide significant tax advantages, such as reducing estate taxes by removing assets from a taxable estate.

Certain types of trusts, such as irrevocable life insurance trusts, also known as ILITs, can help protect life insurance proceeds from estate taxes. Trusts can also facilitate the efficient transfer of wealth to heirs while reducing potential gift and generation-skipping taxes.

Can a trust help my family avoid probate?

If the trust is properly set up, the assets in the trust do not pass through probate and can be distributed according to the trust deed.

What is the difference between a revocable trust and an irrevocable trust?

A revocable trust allows the trustor to retain control of the assets, including the ability to modify or revoke the trust.

In contrast, A Irreversible Once created, a trust cannot be changed and offers greater protection from creditors and potential tax advantages.

Can a trust help me protect my family’s financial future?

A trust can protect your family’s financial future by reducing your tax burden and providing opportunities to transfer your wealth while still being protected.

For example, Bruce has three children and two grandchildren.

He loves all of his children equally, but they are at very different stages of life. One is married, the other is separated, and the third is a spendthrift.

He wants all of his children to be treated equally and does not want their inheritance to be spent recklessly or lost in a divorce settlement.

By establishing a trust and having a qualified trustee, He can transfer assets during his lifetime and has clear criteria for when and how The money will be distributed Children as beneficiaries.

Are trusts only for wealthy individuals, or can anyone benefit from using them?

Confidence is not a one-size-fits-all thing.

Although wealthy individuals have more wealth to protect, there are many reasons why people of different income and asset levels benefit from a trust.

Some uses of trust funds are:

- To transfer your wealth tax efficiently.

- To protect a child who has a disability or is a minor.

- To maintain real estate confidentiality.

- To help avoid conflict and ensure assets get where you want them in the event of a blended or large family.

- For more flexibility in planning, such as when you have a family business and want to distribute your assets equally among family members working inside and outside the business.

- For more customization options and restrictions, with estate planning, such as if you want your second spouse to remain in your primary residence, when they pass, it goes to your designated beneficiary(ies) and does not form part of the spouse’s estate.

Who should seriously consider getting a trust?

You should seriously consider getting a trust if you:

- You have a child with special needs because there are tax advantages, and you will want to know that he or she is protected when you are not around.

- You have a complex estate with assets and beneficiaries in multiple countries.

- You have a blended family and want to prevent conflicts.

- You have a business with some family members as part of the business, others not.

- Do you need creditor protection or are concerned about potential lawsuits?

Final thoughts

Trusts are a powerful and versatile estate planning tool. They provide control, privacy, tax efficiency and asset protection.

Whether you want to simplify the transfer of wealth, support loved ones with special needs, or avoid the complexities of a will, trusts can help achieve your goals. However, not all trusts are the same, and proper preparation is essential to ensure your wishes are met. By working with experienced legal and financial professionals, you can design a trust that fits your unique needs and protects your family’s future.

Get the free guide and audio meditation to make your dreams come true

Enter your email address in the form below to get my easy checklist and guide Showing A guided audio meditation to help you get started.

You’ll also receive one or two emails a month with the latest blog posts on abundance, building wealth, manifesting, and creating a fulfilling life.