Let’s talk about building wealth to continue

Q: What is the best way to build the wealth of generations?

If you want to know how to build the wealth of generations, you are likely to be a paid and directed person. Want A clear path It will allow you to do so Building wealth that can be transferred to future generations. To build and protect the wealth of generations, you must create and implement an old plan.

By creating an old plan, not only protects your financial contributions, but also enhances the lessons you want to instill in your family. The old plan helps your inheritance to manage the wealth that you worked hard to create.

Even today, I will share seven steps that everyone needs to build and protect the generations.

Written by Tiffany Woodfield, Mali Coach, TEP®, CRPC®, CIM®

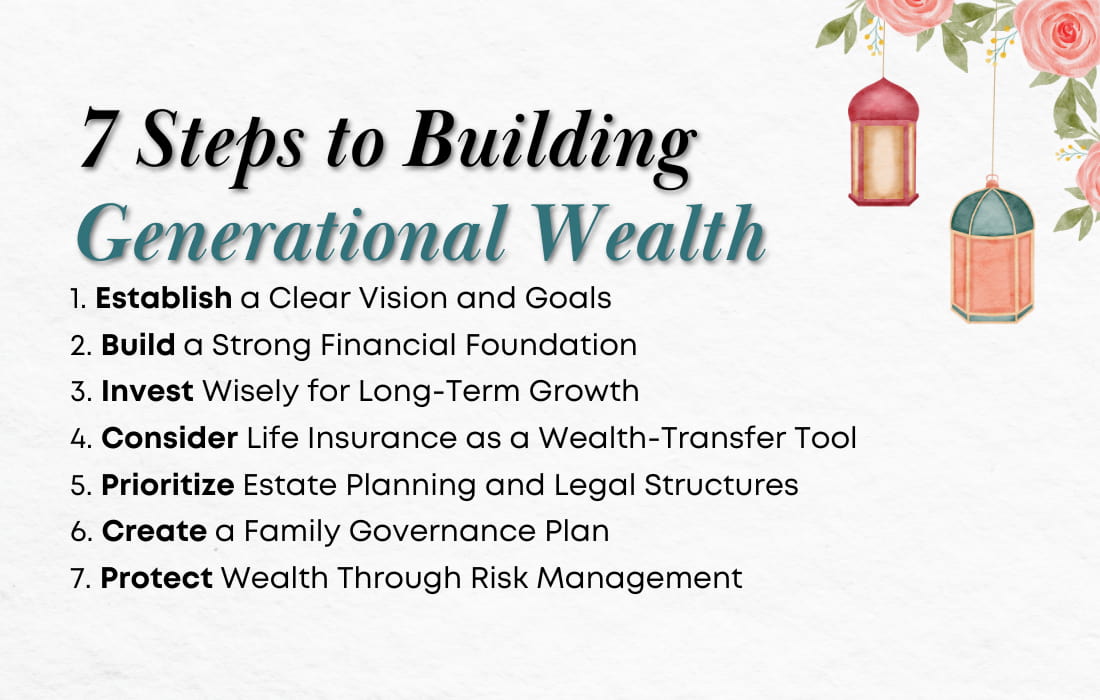

7 steps to build the wealth of generations

1. Setting a vision and clear goals of wealth

The first step to build wealth generations is to create a clear vision and set specific goals for what you want to achieve.

This may mean obtaining a second property, launching a company, or providing retirement.

The presence of concrete targets means that you can divide your big dreams into controlled small steps. The presence of a clear focus will motivate you and facilitate tracking your progress. There will be a lot of bumps on the way and you are working to leave a permanent legacy for your family. So you will want to get a clear goal and vision that makes you continuous!

2. Build a strong financial basis

You need a solid base to successfully develop wealth.

Just like the house, your wealth is only as strong as the foundation that was built on it. It includes the strong foundation:

- Debt management

- Budget

- Emergency funds and money flow

Debt management

To free more money to invest in your future, track what you owe.

Do not let the debts go out of control, and make sure to pay the high -benefit debts (such as credit cards) first so that they do not add and become a greater problem.

Budget

The budget can enable you to make better financial decisions because you know exactly where your money goes every month.

Many people who start budget are surprised to find “money leakage”. Money leakage is an area where you did not realize money. Finding these leaks is similar to finding money in your pocket!

By not spending the things you don’t want, you will have more of what you really care about. And you will be able to reach your goals more quickly.

Emergency funds and cash flow

The emergency fund is the savings account allocated to unexpected expenses.

It creates a pillow to help prevent you from going to debt. Good cash flow management is important. You need to know the amount that will come and go out every month.

Quick Video: 3 tips to start the budget

You can use this Three simple steps tips to start the budget So you can achieve financial freedom more quickly and easily! Make sure to click the subscription button if you are a YouTube user until you get more videos in your salvation.

3. Invest wisely for long -term growth

To build the wealth of generations, you should avoid trying to “the time in the market.”

Instead, allow your money to grow over time. Think of investment Cultivation of seeds today To enjoy your garden from wealth tomorrow.

In addition, it is important to diversify your investments across different asset categories, such as stocks, bonds and real estate. This helps reduce your risk, allowing you to stay in the long run. When you have enough assets, it helps to work with a financial professional.

They can give you advice to suit your needs and goals.

Usually, if you have one million dollars or more in unnecessary assets, it’s time to start searching for a qualified financial advisor. Search for a credit financial advisor, CFP manager or wallet.

In Canada and the United States, life insurance can be an effective means of taxes to transfer wealth to beneficiaries.

Life insurance is often used in Real estate planning For the following reasons:

- To create a property for your family to cover the expenses when it disappears.

- To achieve equality in the property for family members when business is involved.

- To create liquidity in a property so that you do not need to sell a large origin or a great work after your death.

People are often suspicious of life insurance. However, it can be a very smart way to leave more of your heirs. Keep in mind that life insurance revenues are received as an useless beneficiary in the total income. In other words, you do not pay a tax to pay life insurance compensation.

5. Give priority to real estate planning and legal structures

Real estate planning is necessary if you want to distribute your assets according to your desires.

By developing a strong real estate plan, you can reduce potential conflicts between family members and provide taxes. Keep in mind that the will is not a real estate plan. No confidence.

A will It determines how you want to divide your property and assets after your passage. trust They are flexible legal structures. They allow you to control how to manage your assets and share them while you are alive and after death. With confidence, you can set specific rules about when and how the beneficiaries receive their inheritance.

The real estate plan will cover all aspects of the estate.

6. Create a family governance plan

A Family governance plan It is the key. It ensures that everyone understands financial decisions and family goals.

The plan creates a clear system for making decisions and communication between family members. This helps prevent misunderstanding and conflicts.

Teaching the next generation about financial literacy and wealth supervision is important. It aims to enable them to know and skills to manage and wealth for your family responsibly.

7. Protect wealth through risk management

Risk management includes determining potential risks that may affect your assets.

Some examples include unexpected medical expenses, accidents, or market fluctuations. An effective way to manage these risks is to obtain the correct insurance coverage.

For example, you may need to secure health, home and responsibility. Correct insurance can protect your money from significant losses.

Common questions

How are most of the generations’ wealth created?

most The wealth of generations It is created by long -term investments, strategic financial planning and smart asset management. Families often build their wealth by placing money in things like real estate or stocks or starting their own business. They also avoid excessive debts.

What is the base of the three generation of wealth?

the The rule is triple For wealth indicates that family wealth often disappears in the third generation. The first generation works hard to build wealth, and the second generation achieved some success in its management.

By the time when it reaches the third generation, it can collapse. The third generation tends to have no engine, discipline, and financial knowledge to maintain wealth and development.

What is the most common way to build wealth?

The most common way of Build wealth Through a mixture of savings and investment and gaining fixed income. People often begin to provide part of their profits and then invest this money in assets such as stocks, bonds or real estate, which can grow over time.

What are the best assets to build wealth?

the The best assets The construction of wealth includes real estate, stocks and investment accounts, which gain negative income and grow over time. Consider a variety of investments, and take advantage of the long -term revenue and investment.

Financial stability and inheritance

The creation of the wealth of generations is not only related to asset assembly.

It comes to leaving a legacy Financial stability, knowledge and opportunity For people who care more for you. By taking deliberate steps now, you can make sure that your wealth continues to grow and serve your family for future generations.

The key to permanent wealth is not a secret – it is a mixture of Smart planning, disciplined investment, and studied old construction. Whether you just start or improve your financial strategy, the best time to take the action is now.

Every decision you make today approaches a future where your wealth is protected, Your loved ones are safeYour financial goals have become a reality.

So take the next step. Set your vision, build your organization, and put a plan in its place that guarantee your hard life.

You have the ability to create a wealth that lasts – and start with the options you make today!

Get the free guide and audio meditation to show your dreams

Broadcast

You will also get e -mail messages or two per month with the latest blog posts about abundance, building wealth, showing and creating a satisfactory life.

Read more:

💎 How to create the wealth of generations

💎 How to build the wealth of generations successfully

💎 What is the amount of money that is the wealth of generations?

💎 Why is the wealth of generations important?

About the author

Tiffany Woodfield He is a financial coach, an expert across the border and co -founder of Swan Wealth, based in Kelowna, BC. As director of TEP and wallet manager, Tiffany has extensive work experience with successful professionals who want to leave a legacy and enjoy an adventure lifestyle and work manufacturing. Tiffany combined the wide knowledge of its background as a financial professional with training and her passion for personal development to help its customers create a unique road that allows them to live in their maximum capabilities. Tiffany was a regular contributor to Bloomberg TV and was interviewed with national and international publications, including Globe and Mail and Barron.